The lending industry is in the middle of a structural reset. Loan Origination Systems (LOS), once back-office enablers, are now at the center of banks’ digital strategies. With AI maturing, cloud adoption accelerating, and embedded finance blurring the lines between financial and non-financial ecosystems, LOS platforms are being re-imagined for speed, scale, and customer-centricity.

The global LOS market is projected to grow from USD 5.87 billion in 2024 to USD 6.58 billion in 2025, representing a 12.1% CAGR (The Business Research Company, 2024). This growth is fueled not just by technology shifts, but by rising customer expectations, regulatory scrutiny, and competitive pressure from FinTechs.

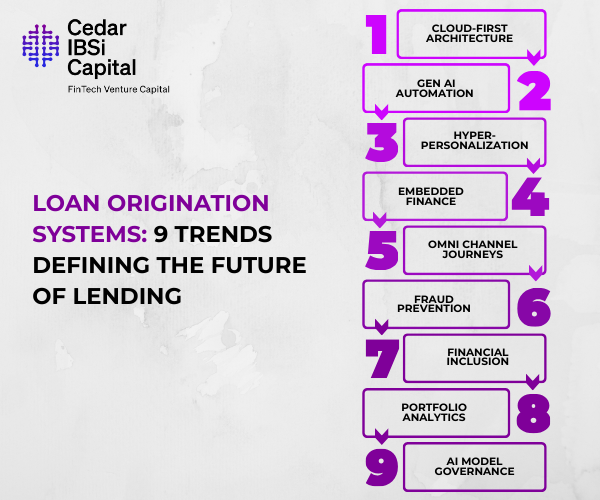

So, what are the defining trends?

1. Cloud-First and API-Driven Architectures

Cloud-based LOS are moving from optional to mainstream, offering scalability, faster deployment, and seamless integrations. An API-first approach allows banks to embed origination workflows into e-commerce, B2B portals, or SaaS platforms—powering embedded lending opportunities (LendFoundry, 2025).

2. AI, GenAI & Automation

From underwriting to fraud detection, AI automation is reducing manual workloads and improving decision accuracy. Early adopters of GenAI underwriting assistants report 3–5× efficiency gains (Turnkey Lender, 2025). The shift toward real-time lending, especially for retail and small-ticket loans, is now viable (NovacTech, 2025).

3. Hyper-Personalization

LOS platforms are harnessing behavioral data, predictive analytics, and dynamic scoring to design tailored loan products. This personalisation goes beyond risk profiles—it extends to pricing, repayment structures, and even communication styles (Verified Market Reports, 2025).

4. Embedded Finance

LOS no longer lives only within banks. By 2025, more platforms are embedding lending within point-of-sale (POS) and digital marketplaces, enabling instant credit decisions at the customer’s moment of need. AI is amplifying this with contextual offers (Biz2X, 2025; LendFoundry, 2025).

5. User Experience and Omnichannel Journeys

Borrowers now expect frictionless, digital-first journeys. Mobile-friendly portals, real-time status updates, in-app document uploads, and omnichannel experiences are becoming hygiene factors. Institutions that lag risk customer drop-offs and lost market share (Verified Market Reports, 2025).

6. Compliance, Security & Fraud Prevention

With cyber fraud and regulatory demands escalating, LOS platforms are embedding KYC, AML, audit trails, and biometric verification natively. GenAI-assisted fraud monitoring is adding another layer of proactive defense (NovacTech, 2025).

7. Alternative Credit Data & Financial Inclusion

Lenders are increasingly using utility bills, mobile payments, and behavioral analytics to evaluate borrowers, especially those with thin or no credit files. This is unlocking lending opportunities in rural and underbanked markets (NovacTech, 2025).

8. Portfolio-Level Analytics

Beyond approving individual loans, lenders are applying portfolio risk modeling for stress testing and concentration risk. AI enables cross-portfolio insights that strengthen capital allocation and resilience strategies (ITS Credit, 2025).

9. Explainable AI & Model Governance

As regulators tighten oversight, explainability is as important as accuracy. Research on interpretable large language models shows how AI can become more transparent, auditable, and bias-aware (ArXiv, 2025). LOS must evolve to balance innovation with responsible governance.

Why These Trends Matter

- Speed & agility: Cloud and automation shorten time-to-decision.

- Differentiation: Personalization and embedded finance unlock new customer segments.

- Trust & resilience: Stronger compliance and portfolio risk tools reduce systemic vulnerabilities.

- Inclusion: Alternative data opens the credit funnel to millions currently excluded.

In short: LOS platforms are no longer back-end utilities—they are strategic growth engines.