April 30, 2025

India’s insurance sector continues to play catch-up when it comes to digital transformation. While the pandemic drove the insurance companies to pick up the pace on front-end digitisation, if, as a country, we want to achieve the “Insurance for All” target by 2047, insurance companies need to start modernising their core and middleware system. It will unlock new growth momentum and make scaling up sustainable, resulting in increased investor interest.

As a result of front-end, customer-facing digitisation, user experience has improved drastically despite the insurance penetration being stuck at ~3.5% of GDP – far below-developed economies, which are at ~11%. Few noticeable key enablers of digitisation have been:

- E-KYC, Aadhaar authentication and payment APIs forming the foundation layer.

- IRDAI to enable web aggregators and digital-first insurers to operate independently.

- Policy issuance, onboarding, and claims processes receiving a digital ‘boost’ due to the pandemic.

If Indian insurance companies continue to remain on the growth path, system upgradation is no longer optional, but it needs to become part of the core strategy. It’s not just about growth, but it fixes systemic inefficiencies. Tier 2 and 3 towns continue to remain under-served due to high distribution costs. Most consumers lacked visibility into policy terms and pricing. Manual claims and servicing slow operations, increase costs and lower customer satisfaction. Technology helps bridge these gaps—accelerating issuance, expanding reach through mobile channels, and enabling transparent, self-driven insurance purchases.

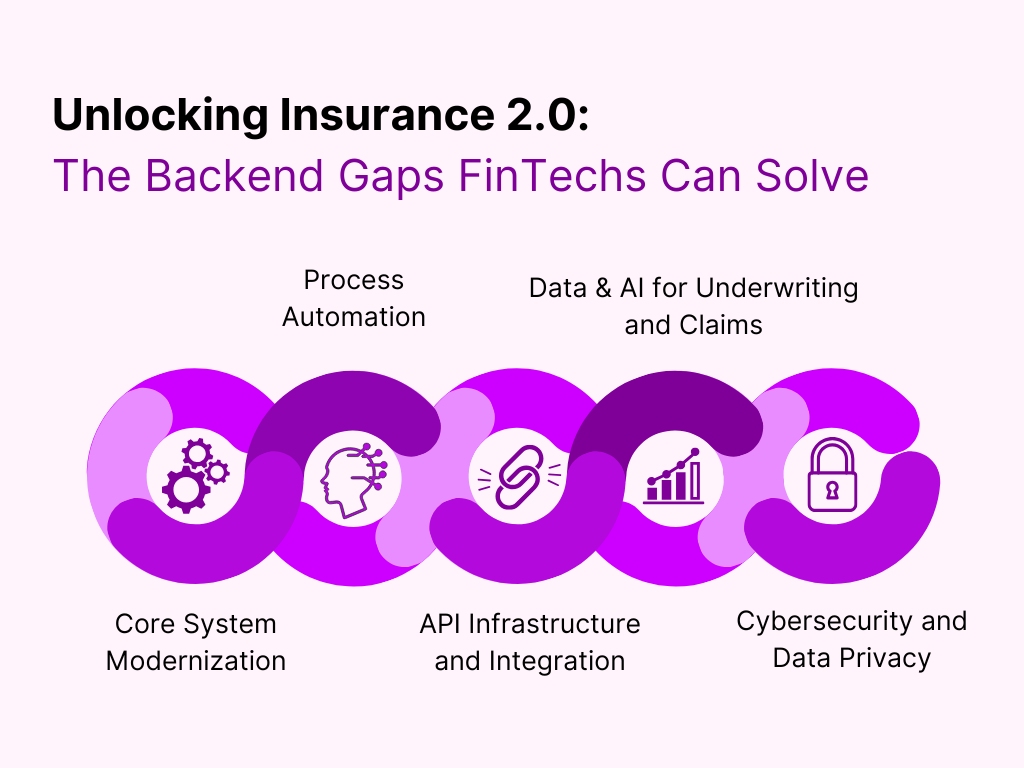

Opportunities for B2B FinTech and BankTech Startups: Solving Insurance’s Backend Bottlenecks

India’s insurance sector continues to run on outdated infrastructure. While digital front-ends have improved, legacy systems, manual workflows, and fragmented data continue to restrict speed, scalability, and innovation.

- Core System Modernization

Most insurers operate on legacy systems that are slow, inflexible, and costly to upgrade. Startups offering modular, cloud-native platforms—like those from EbaoTech India—are enabling phased modernisation with lower risk. Plug-and-play policy or claims modules allow for gradual legacy replacement while enhancing agility. - Process Automation

Functions like claims, renewals, and commission payouts remain manually intensive. FinTechs are streamlining these with RPA, AI-driven workflows, and low-code automation. HDFC ERGO, for example, now processes 75% of motor claims digitally using OCR and image recognition. - API Infrastructure and Integration

Legacy stacks lack APIs, making integration with partners and regulators difficult. Startups are filling this gap with middleware platforms and standardised insurance APIs—enabling faster rollout and easier compliance. - Data & AI for Underwriting and Claims

Insurers have massive data sets but limited tools to extract value. AI-driven models can improve risk profiling, detect fraud, and enable personalised pricing. Cogniquest, for instance, uses document intelligence to automate underwriting insights. - Cybersecurity and Data Privacy

With greater digitisation comes heightened cyber risk. Startups like Safe Security are helping insurers comply with India’s DPDP Act through role-based access, encryption, and real-time digital risk scoring.

What’s Coming Next

- Micro & Contextual Insurance: Short-term, event-based products tailored for gig workers, rural consumers, and underinsured segments.

- Climate & ESG-Aligned Cover: Parametric insurance and catastrophe-linked products, especially in agriculture and MSMEs.

- Data-Driven Personalization: IoT, wearables, and real-time behaviour data will enable custom pricing in motor and health insurance.

- Digital Bancassurance: Banks are embedding insurance journeys in mobile apps. FinTechs can power analytics, servicing, and compliance.

- Unified Policy Infrastructure: IRDAI’s upcoming Bima Sugam platform aims to become India’s “UPI moment” for insurance—centralising distribution, servicing, and claims.

Conclusion: A Sector Ready for Infrastructure-Led Innovation

India’s insurance sector has embraced the front end of digitisation—but transformation at the backend remains incomplete. This is where the next wave of innovation lies.

FinTechs and infrastructure startups that modernise core systems, unify APIs, automate operations, and secure data flows will define the next phase of insurance growth. Not by building the next aggregator—but by solving the harder, deeper problems that slow the industry down. As India advances toward financial inclusion, the chance to build digital insurance rails—from the inside out—is now. The startups that solve boldly and scale smartly will power the future of insurance in India.