July 25, 2025

The definition of wealth is no longer limited to tangible assets—it has taken on new forms, including digital currencies and tokenised securities. As a result, the business of managing wealth is undergoing a profound transformation.

Drawing from research in IBS Intelligence’s report on wealth management (WM) and private banking (PB), we can undeniably see the future being shaped by automation, digital-first experiences, and a platform-led approach. However, experts remain divided on whether the technology will replace relationship-driven models or play the role of an enabler.

The Shifting Foundations of Wealth

By 2040, wealth will not only expand but also redefine itself around a tech-savvy, empowered and financially aware customer base that demands instant access, personalisation, and new asset classes. As artificial intelligence (AI), machine learning (ML), and APIs become mainstream, WM & PB institutions are exploring ways to embed these technologies to enhance client relationships and operational efficiency. For WM & PB to remain competitive within the ecosystem, the adoption of new-age technologies will become a necessity rather than a luxury.

Who’s Driving the Change?

The wealth management sector is propelled by a complex ecosystem of stakeholders—each with distinct roles, incentives, and degrees of influence. Understanding this web of relationships is key to navigating transformation.

- Internal Stakeholders- These include employees, management, and internal investors who are deeply embedded in day-to-day operations. Employees provide critical execution capability, and engaged teams are often correlated with stronger customer experiences and better overall performance. Meanwhile, managers and internal investors must bridge organizational execution with long-term strategic objectives, carefully aligning internal goals with firm-wide success.

- External Stakeholders- Externally, the landscape widens to encompass customers, regulators, suppliers, and even broader communities. Customers drive demand for innovation, digital experiences, and value-added services. Regulatory bodies shape the operating environment through rules like fiduciary responsibilities and data protection, underscoring compliance as both a risk and a competitive differentiator. Suppliers and vendors, on the other hand, ensure firms have access to vital services and technologies needed for transformation.

- Primary vs. Secondary Stakeholders- Primary stakeholders, such as shareholders and business partners, have direct economic exposure and significant influence over a firm’s strategic direction. They stand to gain—or lose—if competitive standing shifts, and often drive capital allocation decisions. By contrast, secondary stakeholders, including legal, tax, and financial advisors, don’t engage directly in core economic exchanges but influence operations via counsel, compliance, and oversight. Their contributions support stability and risk management, especially in complex financial ecosystems.

As firms evolve, newer players—especially WealthTech startups—are leveraging APIs and seamless digital workflows to create differentiated value for both customers and institutions.

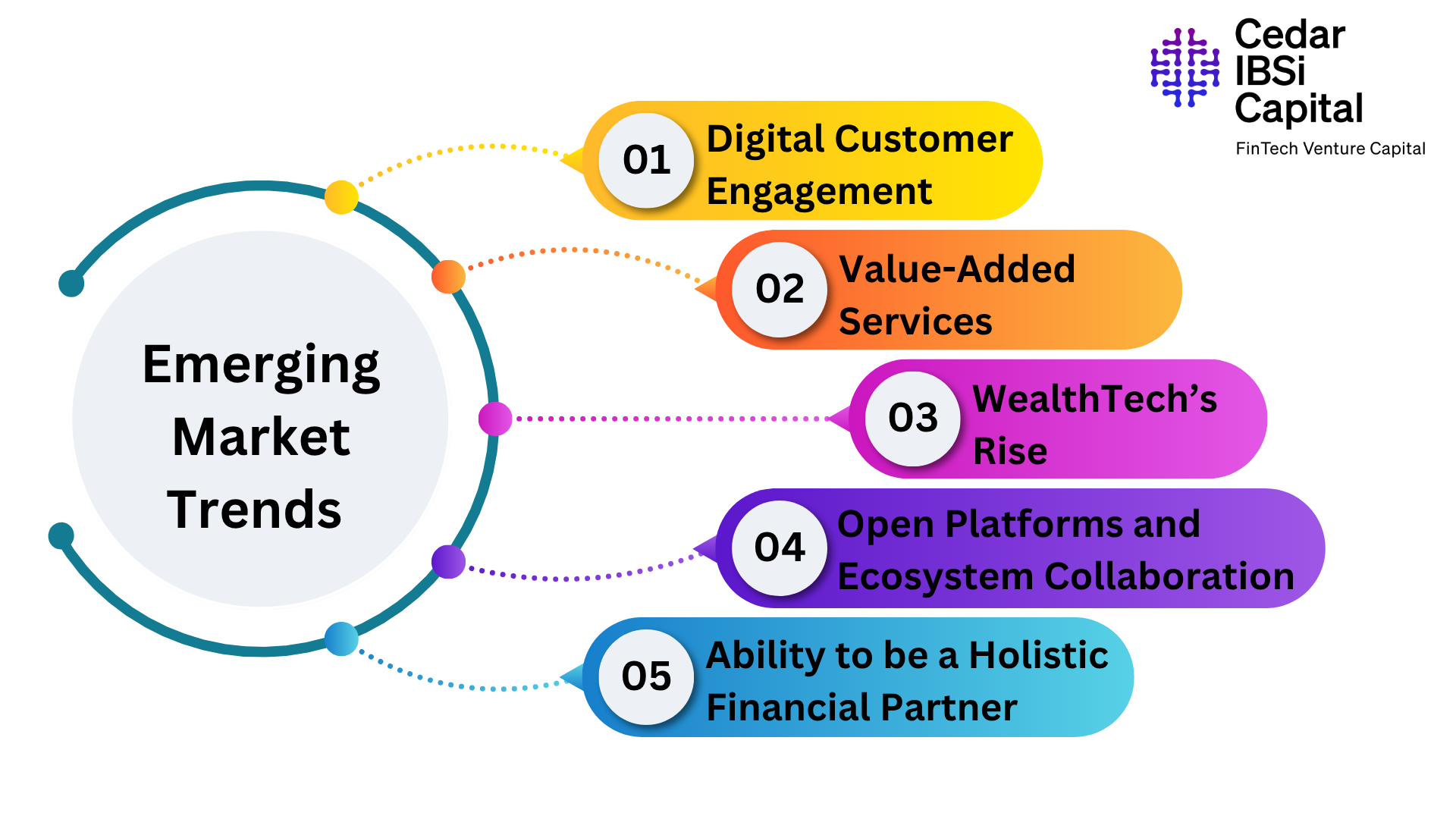

Emerging Market Trends Reshaping the Industry

1. Digital Customer Engagement that offer seamless, omnichannel access to wealth services.

2. Value-Added Services beyond core wealth offerings, and layered services like financial planning, including real estate advice and tax optimisation.

3. WealthTech’s Rise is redefining how investment, trading, compliance, and personal finance are delivered, tailoring experiences and reducing friction.

4. Open Platforms and Ecosystem Collaboration means that consumers increasingly rely on multiple financial service providers. Embedded WealthTech is driving this new interoperability.

5. Ability to be a Holistic Financial partner rather than just product providers.

Threats That Can’t Be Ignored

Amid opportunity, challenges loom large:

- Compliance costs are rising due to privacy regulations (e.g., GDPR, Fiduciary Rule), prompting firms to turn to RegTech and WealthTech partners for support.

- Margin pressures are mounting from transparent pricing and passive alternatives.

- Ageing advisors highlight the urgent need to attract younger, tech-savvy professionals who can engage with millennial and Gen Z investors.

- Cybersecurity threats are escalating with digitisation, demanding stringent data protection.

- Governance gaps risk derailing transformation unless reporting and accountability structures evolve in parallel.

What’s Next?

The future of wealth management lies in collaboration between incumbents and disruptors, between data and design, and between advisory and automation. As illustrated by partnerships like UOB and Singtel, or Deutsche Bank and QPLIX, Wealth Tech collaboration is no longer optional—it’s mission-critical. At Cedar-IBSi Capital, we’re closely tracking these shifts and backing ventures that are not just riding the wave of change but actively building the next-generation infrastructure for wealth creation and management.